Identifying Unproductive Inventory and its impact on Financial KPIs in Retail Organisation

March 2023 | 7 minute read

Tagged: DemandForecasting | InventoryOptimization | RetailAnalysis | SKUManagement | WorkingCapital | ProfitabilityAnalysis | ROCE | InventoryValue | FinancialKPIs | RetailEfficiency | BusinessMetrics | InventoryMonitoring | RetailStrategy

In one of our previous articles, “Intelligent Demand Forecasting for Inventory Optimisation”, you would have understood the importance of building an intelligent demand forecasting on AWS cloud system to help businesses optimize their inventory, leading to higher working capital and a positive impact on bottom-line and top-line numbers. In this blog, we would like deep dive into one of the effective ways retailers can identify unproductive Stock Keeping Units (SKUs) and understand the impact on a company’s overall profitability and working capital.

The Pareto principle suggests that ~20% of the SKUs sold contribute to ~80% of the total sales in a retail organization. Retailers often argue that the rest of ~80% of SKUs are present to showcase broad choices available for customers to choose from, increasing walk-ins. While they are essentially correct, because of this extensive variety of SKUs in stores, a large amount of working capital, ~40% more than required, is tied up on these inventories, which later ages and is often liquidated (as unproductive) with heavy discounts or thrown away as wastages.

In the retail industry, FSN analysis is the most used method to identify slow-moving inventory based on consumption rate and frequency. While this is an effective method to classify SKUs, it doesn’t account for the profitability of the business and the capital deployed for the inventory leading to unproductive SKUs present in the system. The retailer may restrict the replenishment of highly profitable and low capital-intensive SKUs due to misclassification based only on consumption rate and frequency of selling.

My approach to solving the above problem is inspired by a metric used in financial statement analysis named Return on Capital Employed (ROCE), where a business is assessed based on its profitability and efficient use of its capital.

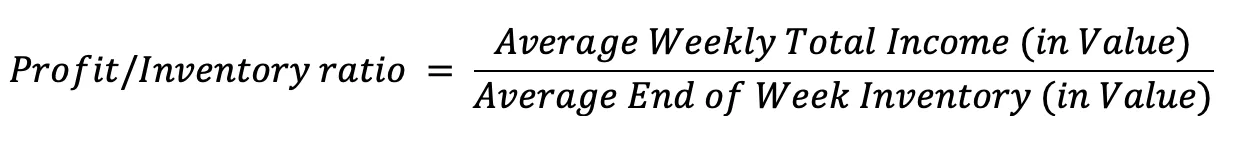

The key metric to identify these SKUs which retailer should use would be Total Income (Margin — Loss/Wastage) divided by Inventory value deployed for across various time frame (in figure below we would use weekly as time bound component)

In the above equation, the numerator captures the average profit earned by the SKU across weeks, and the denominator captures weekly capital deployed.

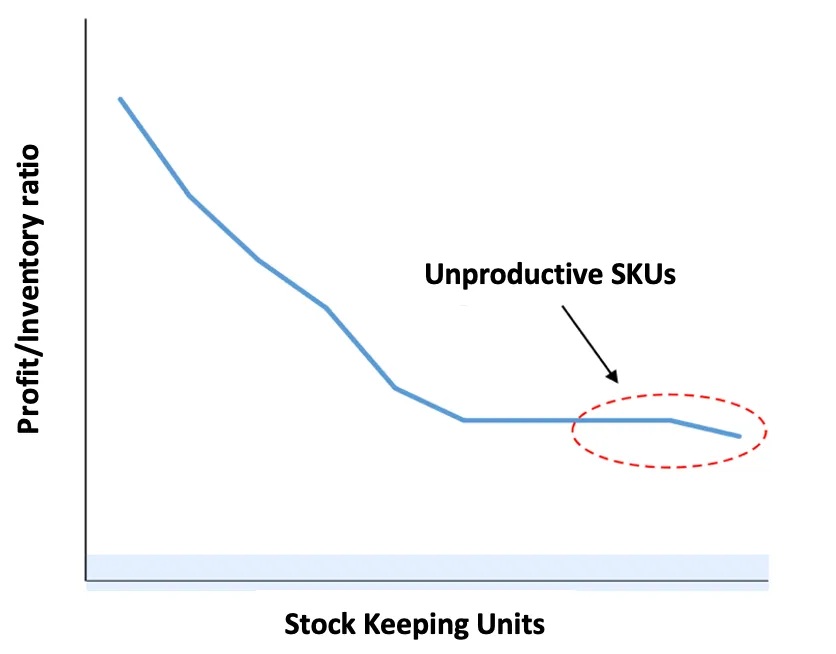

Figure 1: Representation on possible distribution of SKUs upon carrying out the analysis

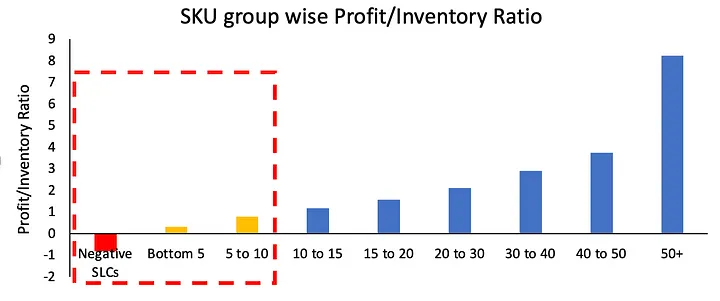

The retailer can then use various bucketing techniques to classify and group these SKUs based on a particular order. In this example, SKUs are bucketed into nine such groups based on the ratio (exception: all negative ratios are grouped in a single bucket).

Figure 2: Representation of how SKUs can be grouped based on measure

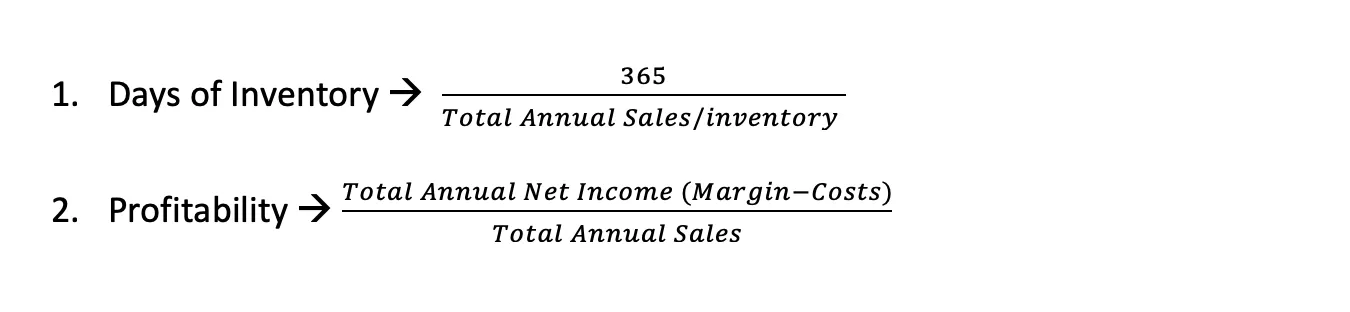

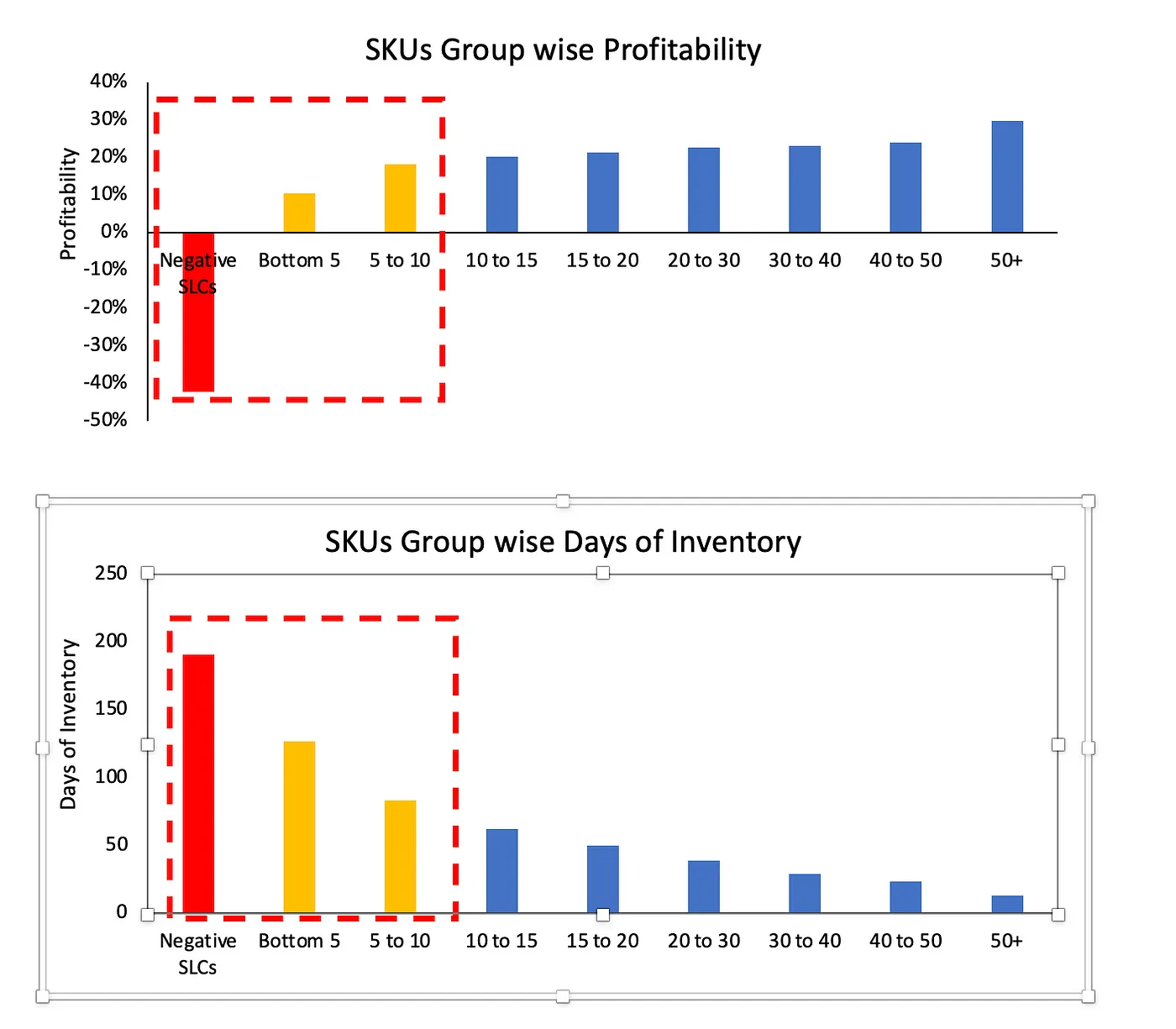

Once the classification is done, it is important to understand how these SKU classification perform on various financial Key Performance Indicators (KPIs). For this blog we will use 2 important KPIs

Sample results based on the above metrics would be

Figure 3:Representation of SKU Groupwise KPIs performance

From the charts like above, retailer can clearly identify the SKU groups which are impacting its business and take corrective actions accordingly.

Conclusion:

In the short term, the retailer can immediately identify unproductive store inventory and stop replenishment using the above analysis. Automated monitoring systems can be built to regularly track unproductive inventory and ensure faster liquidation/promotion-based selling of these SKUs to avoid negative margins.

In the long term, this analysis can be extended towards each region and store, combining with other metrics like city affluence and SKU elasticity to create an assortment mix which maximises profit and has localised and nationally standard assortment mix within the store. Retails can leverage the demand forecasting and inventory optimisations tools to ensure limited inventory is purchased for the selected assortments.

To learn more about Ganit and its solutions, reach out at info@ganitinc.com.